TSMC: $30 billion 2021

Highest priority to automotive ICs

The IC shortage will drag on into 2022 - but TSMC CEO Wei gives the all-clear for automotive chips.

TSMC is putting even more money into new capacity this year than originally planned: $30 billion instead of the previously announced $25 to $28 billion.

Overall, the shortage of chips would continue through this year and extend even further into next year, TSMC CEO C.C. Wei said at an investor conference last Thursday.

Automotive ICs top priority

For the automotive industry, however, he announced good news: "The supply situation in the automotive chip sector will ease a lot in the coming quarter."

This is because TSMC had already decided in January to give top priority to the production of automotive chips and adjusted its wafer capacity accordingly.

"However, the situation worsened because of the impact of the snowstorms in Texas and because of a fire at a fab in Japan," C.C. Wei said.

It should also be noted that the automotive supply chain is long and complex: from chip production to car production takes at least 6 months, with many intermediate steps and many companies involved. However, from the third quarter of 2021, the measures introduced in January would be felt by automotive customers.

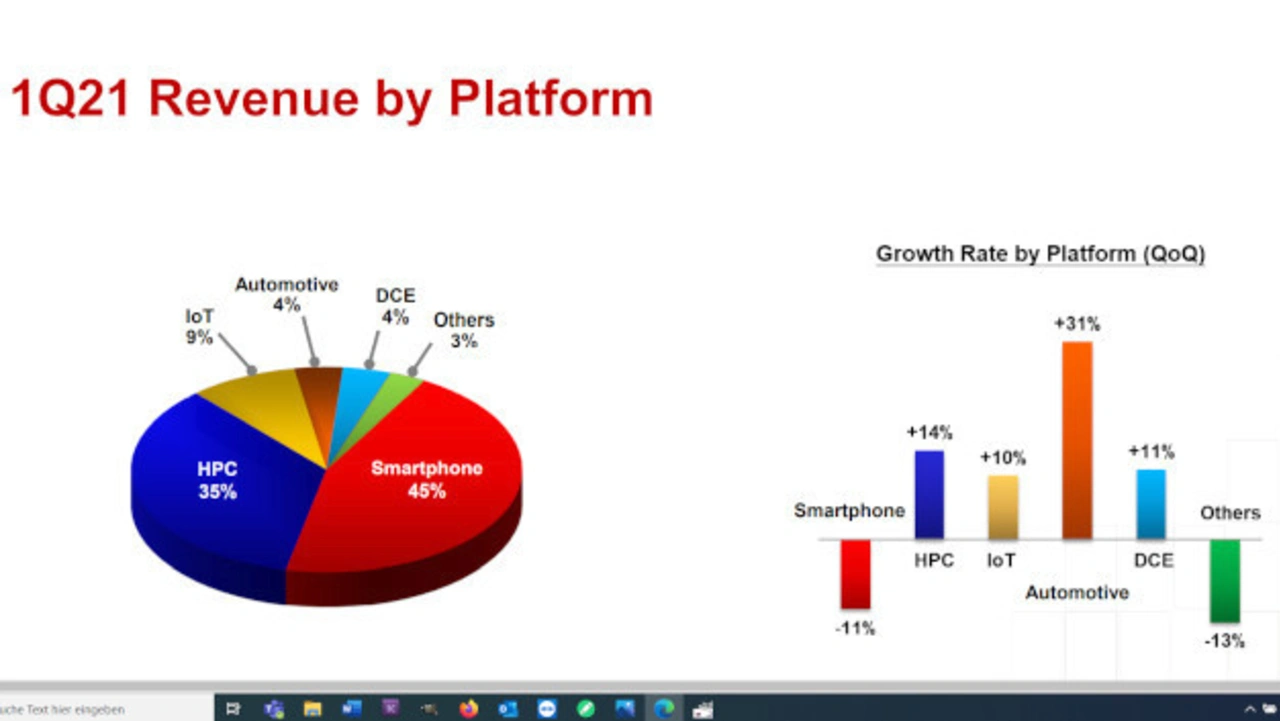

In the first quarter of 2021, TSMC generated 4 percent of its revenue from automotive ICs. Chips for use in smartphones, on the other hand, accounted for 45 percent followed by high-performance computing at 35 percent and IoT at 9 percent. However, the share of automotive chips skyrocketed 31 percent in the first quarter, followed by HPC (14 percent). Smartphone chip share fell 11 percent.

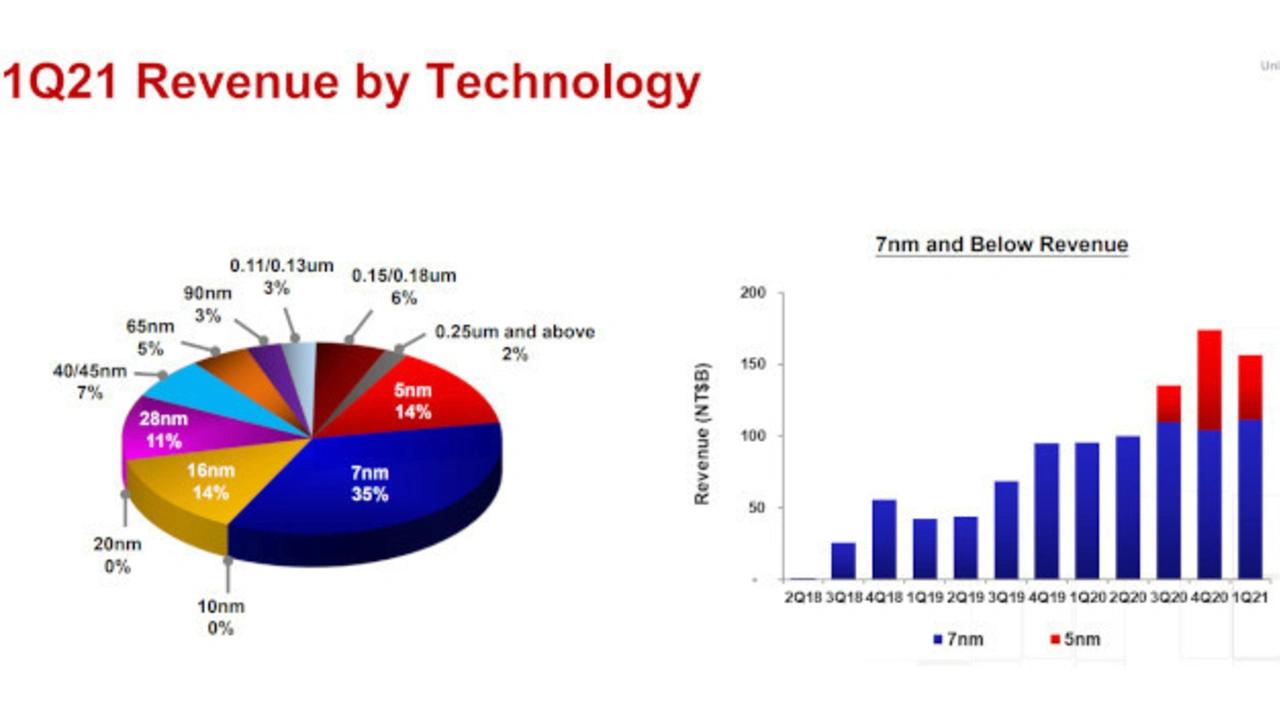

ICs manufactured using 7-nm processes accounted for the largest share of sales in the first quarter of 2021. 5-nm ICs already account for a 14 percent share - exactly as much as TSMC generated with 16-nm ICs. 28 nm ICs account for 11 percent, followed by 40/45 nm with 7 percent, 65 nm with 5 percent and 90 nm with 3 percent. The older 0.15/0.18 µm ICs still account for 6 percent and the 0.11/0.13 µm processes for 3 percent.

Demand for 3-nm and 5-nm ICs is high

This year and in the following two years, TSMC plans to invest a total of $100 billion. As C.C. Wei explained, demand for ICs manufactured using 5-nm and 3-nm processes is so high that capacity needs to be expanded quickly. In particular, 5G equipment and high-performance computing (HPC) demanded chips with the smallest possible structure sizes.

Therefore, 80 percent of the investment budget will go into 3-nm, 5-nm and 7-nm processes. TSMC plans to put 10 percent into the expansion of older process levels.

Geopolitical tensions - higher inventories

Almost all customers would build up larger inventories in light of geopolitical tensions and the impact of the Corona pandemic, according to C.C. Wei. He did not want to rule out the possibility that multiple orders might give the impression that demand is higher than it actually is. But the structural demand is real in any case.

In addition, manufacturers with their own fabs are increasingly outsourcing parts of their production. He cited Intel as one example.

10 to 15 percent CAGR by 2025

Driven by the high investments, TSMC is expected to achieve an average annual revenue growth of 10 to 15 percent by 2025, he said. For this year, TSMC has revised revenue growth upward from 15 percent to 20 percent. This quarter, TSMC expects revenue to be between $12.9 billion and $13.2 billion, which already includes the impact of the power outage at Fab 14 in the South Taiwan Science Park. In the previous quarter, revenue had been $12.75 billion.

No production downtime due to water shortage

Because there has been unusually little rain in Taiwan over the past few years, water is scarce on the island nation and train day is regulated by the state. However, TSMC has long established a risk management system, so the company is coping well with that, too, according to C.C Wie. "The government-mandated limit on water consumption has not affected our production so far, and I don't expect it to affect us in the future," C.C. Wei said.