Efinix

»We were able to exceed our own expectations.«

Fortsetzung des Artikels von Teil 1

Using standard processes brings advantages

But surely this is also true for Xilinx/AMD or Intel, only FPGA vendors that rely on a Flash process cannot use pure CMOS processes, so to what extent is this really an advantage of Efinix?

I don't want to talk about the specifics of the silicon processes used by other FPGA vendors. But one thing is clear: even the vendors that don't use flash technology tend to adapt the standard CMOS flows to accommodate the special requirements of FPGAs. This is different at Efinix: the efficiency of the Quantum fabric and the routing capabilities of the XLR allow Efinix to not require us to make these changes.

But we have another advantage: our Trion family is manufactured at SMIC. And SMIC has been able to meet our requirements without any major bottlenecks. Of course, we also see the bottlenecks in substrate procurement, but here too, our planning team has been able to ensure as far as possible that sufficient material is available. The sales organization works very closely with the planning team as well as the customers so that material can be ordered early to supply our ongoing projects. New projects are discussed with our planning team in close cooperation in order to be able to plan the delivery times that the project requires.

I am also convinced that the good contacts between Efinix and the foundries is critical in the process. We maintain close contact at the CEO level, and that certainly helps.

Beyond that, there is another point that helps us: Efinix talks about completely different volumes than the two big providers. This means that we can focus mainly on procuring the products in our Trion family, plus the procurement of a few Titanium FPGAs. It's a different story for the market leaders. They have to produce a lot of different FPGA families in a wide variety of processes, which can of course be a bit more difficult.

There were not only bottlenecks in front-end capacities, but also in substrates, leadframes and even potting compounds, plus Corona-related interruptions in ports, etc. Therefore, the question specifically: What delivery times can Efinix offer?

We do not give worldwide delivery times for all products; in these times we could not seriously do that. We work closely with our planning team on this. Each individual project is discussed beforehand and it is decided whether we can support this project or not. If we support the project, the appropriate materials are purchased early and the planning is prepared accordingly, so that we can supply the projects in the required time. Our Titanium family, is also available for projects, since a pure CMOS process is also required in this case, which, as I said, is preferred by the foundries. Here we also achieved the required delivery time for the supported projects. So far, we have been able to support all projects that have come our way.

How do you assess the further delivery situation for Efinix?

From the information we receive from our suppliers, we assume that the supply problems will certainly continue this year, if not into next year, and will only improve slowly. We think it is very likely that production lines that are no longer profitable enough will be closed in the near future. This mainly concerns older products that still use geometries that are no longer recommended for new designs. That's why it's really important to use the right process technology with the appropriate factories.

And what do you think are the right processes? The biggest bottlenecks currently occur with older process technologies, and this will not change in the near future, because the majority of the capacity expansions now announced, at least on the foundry side, concern the smallest process geometries?

I would say quite clearly: every company should select the geometries that are attractive for a particular foundry, because older processes quickly get sidelined in the event of supply bottlenecks. Our processes at SMIC and TSMC meet exactly this requirement.

At some point, supply bottlenecks will be overcome, so how does Efinix plan to grow?

We are focusing on the Titanium FPGA family, or the availability of components with high-speed SERDES, i.e. 16 Gbps. These interfaces will open more doors for us in the market. We include 10 Gbps Ethernet and MIPI-CSI/DSI interfaces in the area of industrial cameras and displays, as well as fast PCI Express interfaces, which can be used to quickly connect data to processors. These interfaces are also of interest to the automotive sector, as the volume of data that has to be processed and transmitted there is constantly increasing.

Thanks to our Quantum architecture, we have advantages in terms of speed and power dissipation, two points that are playing an increasingly important role with our customers. In addition, we have support for LPDDR4/x with up to 3733 Mbps and support for MIPI 2.5 Gbps, together with the various interfaces that a SERDES with 16 Gbps allows. So we see ourselves very well positioned from the product side.

But clearly, silicon is only one side, it is also important that we offer more system approaches, and here RISC-V will certainly play a central role.

RISC-V is an interesting approach, but Lattice or Microsemi are also betting on RISC-V, and others are likely to follow, so is the competition for Efinix increasing?

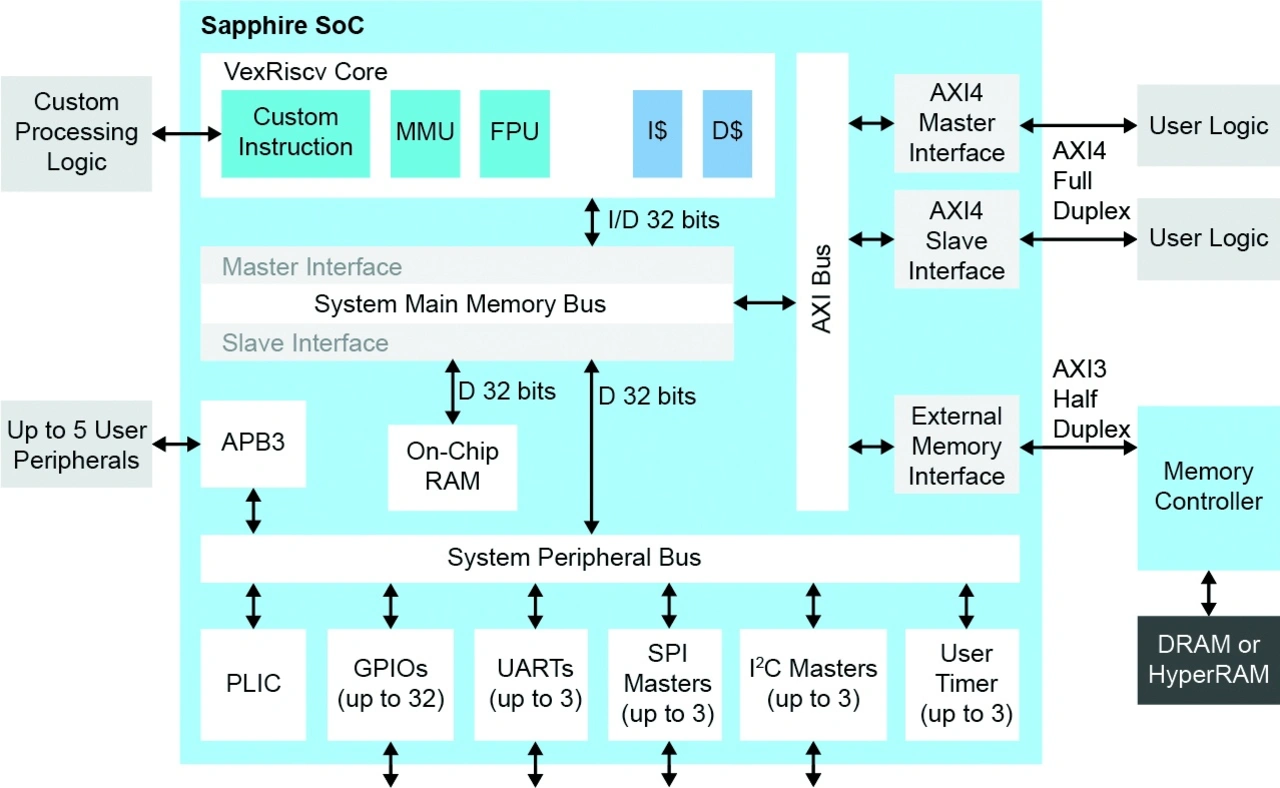

I would say that the growing competition shows that we have backed the right horse, and we are continuing our efforts to make RISC-V accessible to a broader spectrum of developers. We are accomplishing this thanks to our Quantum acceleration initiatives and our SoC reference designs. This allows developers to optimize their hardware/software partitioning in real time by using custom instructions and accelerators to intuitively speed up their software implementations in the FPGA to hardware speeds. Also, support for a floating point unit as well as a Linux MMU enable the broad use of our RISC-V.

In summary, Efinix will grow strongly as a company as we increase our global footprint. This also applies to Europe. We will grow our team as well as be on the lookout for additional resources such as distributors/reps that can help us grow.

- »We were able to exceed our own expectations.«

- Using standard processes brings advantages

- The Goal: become Number 3 in the market

- Hard- versus Soft-IP