Interview with Dr. Peter Wawer, Infineon

»We See Ourselves Very Well Positioned«

Fortsetzung des Artikels von Teil 1

Supply Agreement with Wolfspeed, Acquisition of Siltectra

In February 2018, Infineon signed a long-term agreement with Wolfspeed worth over a hundred million dollars to supply Infineon with SiC raw wafers. Is this a kind of »compensation« for the cancelled takeover of Wolfspeed?

Dr. Peter Wawer: (Laughs.) Among other strategic aspects, the planned acquisition also had the purpose of obtaining direct access to the raw wafers. This was of strategic importance not only with regard to power semiconductors, but especially for our power RF business. As this acquisition was not completed, we needed a new home-base for our power RF business. And so we entered into two agreements with Cree and Wolfspeed. One was to sell our Power RF business to Wolfspeed. The other was the aforementioned long-term supply agreement for SiC raw wafers.

Silicon carbide is from a strategic standpoint highly important to us. After all, the availability of silicon carbide raw wafers might be the limiting factor in the near future, if the demand continues to grow as rapidly as now. With this contract, we have safeguarded significant volumes for the years to come. Currently, the prices for SiC raw wafers are rising rapidly due to the market growth and the limited resources. Both of these factors could contribute to the raw wafers becoming the bottleneck for SiC semiconductor proliferation in the coming years.

Obviously, the takeover of Siltectra at the beginning of November 2018 fits nicely into this picture.

You’re absolutely right. As already mentioned, the number of SiC raw wafers is going to be the bottleneck. The problem is: Nobody can predict how long the bottleneck will last. Only a few companies are currently able to manufacture SiC raw wafers in large volumes. So we started looking for other ways to increase the number of raw wafers available - without entering the raw wafer business ourselves after the unsuccessful acquisition of Wolfspeed.

As a result of our market research, we have identified a number of interesting techniques that can help us with the supply issue – including Siltectra’s Cold Split technology. This start-up company from Dresden was founded in 2010: At that time, the market – in that particular case that for silicon – was empty due to the photovoltaics boom. This led to the idea of splitting silicon wafers using a laser.

But that time is long gone!

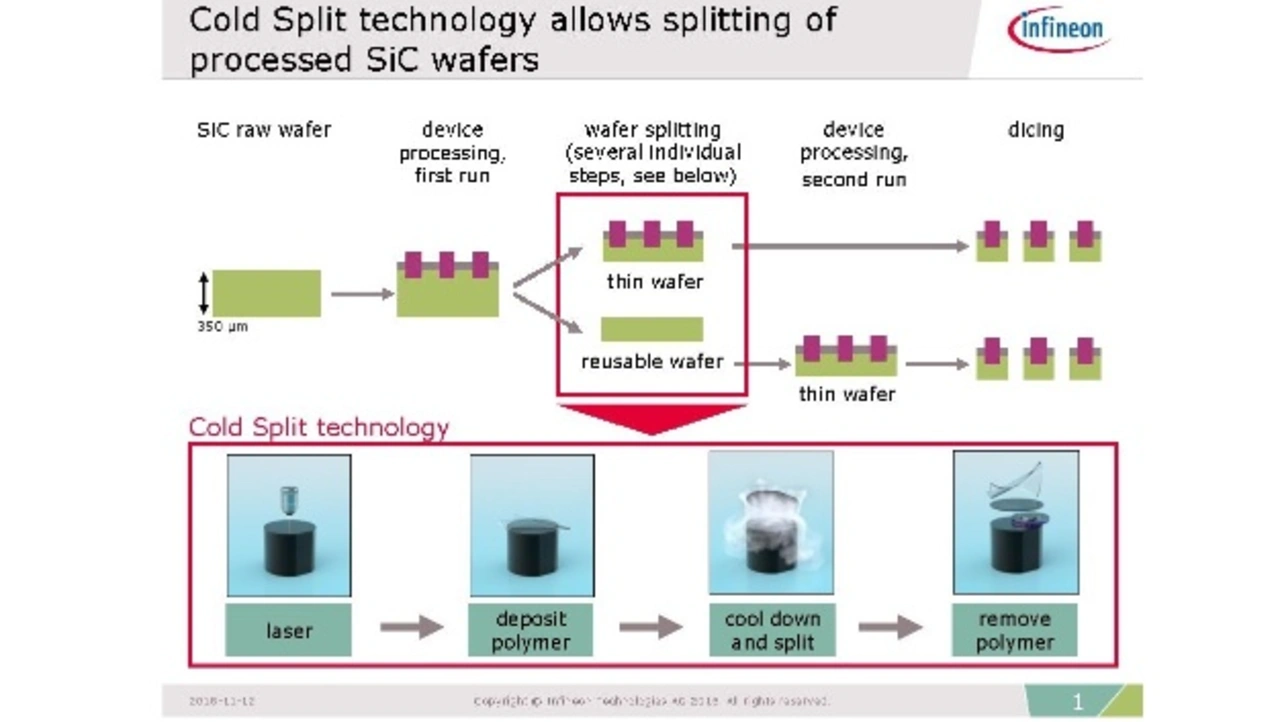

That's right. But the researchers at Siltectra discovered that this process is also suitable for other materials, including silicon carbide. Thus, they further developed it for the much more expensive silicon carbide. A standard silicon carbide wafer is about 350 micrometers thick. A laser is used to introduce energy into the wafer so that it cracks in a controlled manner. By varying the supplied energy and the focusing, the depth at which this splitting takes place can be controlled precisely.

According to the motto »Making two out of one«, this process allows us to create two thin wafers out of one standard wafer – with the larger wafer area for twice as many chips. This obviously brings us certain economies of scale, and the bottleneck in the availability of silicon carbide is not quite as narrow for us anymore.

So how should the entire process eventually take place?

Initially, we will process a standard silicon carbide wafer in the normal way. At a certain stage it is then split via Cold Split. The already processed part will be finished, while the split part will be reintroduced into the front end of the manufacturing process. This process also saves a large part of the thinning required for power semiconductors.

This halves the cost, doesn't it?

(Laughs.) If you leave out the remaining development steps, maybe. At laboratory level, this process already works very well. But until Cold Split runs stable with a correspondingly high yield in mass production, it will still take some time and will require investments. Obviously, the focus of acquiring Siltectra was on increasing the availability of wafers rather than reducing costs.

We are very confident that we will make Cold Split a success, because we have looked very closely at the process in advance and have been processing thin wafers ourselves for decades. This gives us a high level of expertise in this area. Thus, we will also be able to process SiC wafers that are considerably thinner than the usual 350 micrometers.

When will Cold Split be ready for mass production?

The sooner the better, of course. We realistically expect to integrate this new cutting process into mass production within five years. Since we are still in the start-up phase, this means that we still have to develop additional manufacturing equipment. There are already laser machines that work for our purposes in mass production, and we already have some specific ideas as how we could implement them. But there are some process steps at Cold Split where we still have to work hard. So there is still a lot of development work ahead of us.

Is this process also suitable for cutting raw wafers from the primary ingot?

Basically yes. That is also possible. Therefore the process could be very interesting for the manufacturers of the raw wafers.

Will you make this process available to such companies?

Yes, of course. We can well imagine offering this process to different raw material manufacturers as a service for the so-called boule split. We would like to collaborate with our suppliers in this respect. However, we have not yet reached that stage. After the acquisition, we now have to start further developments and corresponding discussions.

That would certainly be interesting for them, because a lot of material is lost while sawing the raw wafers, isn't it?

Correct. As a rule of thumb with silicon carbide, about half of the material is lost during sawing. As it is a complex manufacturing process via a gas phase, the material is considerably more expensive than silicon. And knowing that a 150 millimeter silicon carbide wafer is currently traded on the spot market for well over one thousand dollars it's quite expensive sawdust, isn’t it?

Dr. Peter Friedrichs, Senior Director SiC at Infineon, told me at PCIM 2016 that Infineon has multiple suppliers qualified for SiC raw wafers. Does Infineon fully rely on Wolfspeed now, or are the other suppliers still important to Infineon?

Concerning raw materials, we do not want to rely on a single supplier. But the partnership with Wolfspeed shows that they are clearly our major supplier of silicon carbide wafers. At the same time, we are talking to all our existing and potential suppliers in order to broaden our supply base. In the end, of course, price and quality are always crucial.

- »We See Ourselves Very Well Positioned«

- Supply Agreement with Wolfspeed, Acquisition of Siltectra

- New 300-mm Fab in Villach will also benefit SiC