Comment / Silicon Carbide

Quest for Controlling the Supply Chain

Gregg Lowe's announcement at PCIM 2019 to invest one billion Dollars into expanding Cree's SiC wafer capacity has boosted the quest for control of the supply chain. Will Infineon be the loser after all?

Until recently, only Cree/Wolfspeed and Rohm Semiconductor were vertically integrated, i. e. manufacturing their own silicon carbide (SiC) raw wafers in-house. Even though many competitors have signed long-term supply agreements with the US company, no one wants to be dependent on a quasi-monopolist. As a result, these players are increasingly opting for a two-pronged approach and want to get direct access to the SiC supply chain themselves.

The best example of this approach is STMicroelectronics. Whereas this company had signed a supply agreement worth 250 million dollars with Cree just eleven months ago, it acquired a majority stake of the Swedish SiC wafer supplier Norstel in February 2019. As if that weren't enough, STMicroelectronics doubled its supply agreement with Cree just two weeks ago, only to announce last week that they had been completely acquired Norstel.

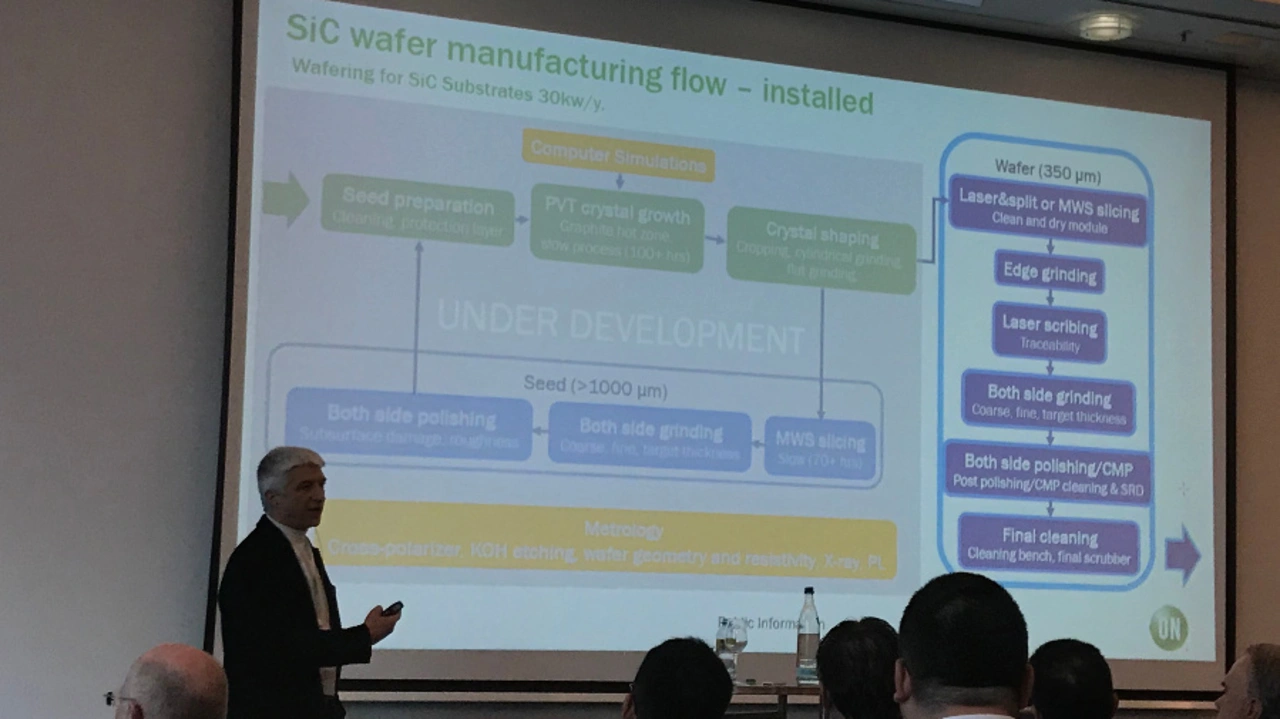

ON Semiconductor now follows the same path. Although the company signed a long-term supply agreement with Cree in August 2019, Thomas Neyer, Vice President and Fellow at ON Semi, revealed this week that ON Semi is working on their own in-house growing and manufacturing of SiC raw wafers (Fig. 1). This will be a massive effort, because manufacturing SiC raw wafers is a cost- and time-consuming undertaking. After all, ON Semi does not have to start from scratch, but can simply take a especially good SiC wafer as a seed crystal.

And where's Infineon? After not obtaining the approval to acquire Wolfspeed, it seems that Infineon won’t get their hand on the supply chain by producing SiC raw wafers in-house, particularly since the Munich company has allocated more than ten billion dollars in investments with the acquisition of Cypress and the construction of a new 300 mm wafer fab in Villach. Nevertheless, Infineon still has a hot potato in the fire when it comes to silicon carbide. Exactly one year ago, they acquired the Dresden startup Siltectra for 124 million euros. With their Cold Split process, you can cut a thick SiC wafer into two thin ones. This also makes it possible to widen the bottleneck to meet the market demand.