European Distribution

DMASS Sees Continued Slowdown in Q1 2025

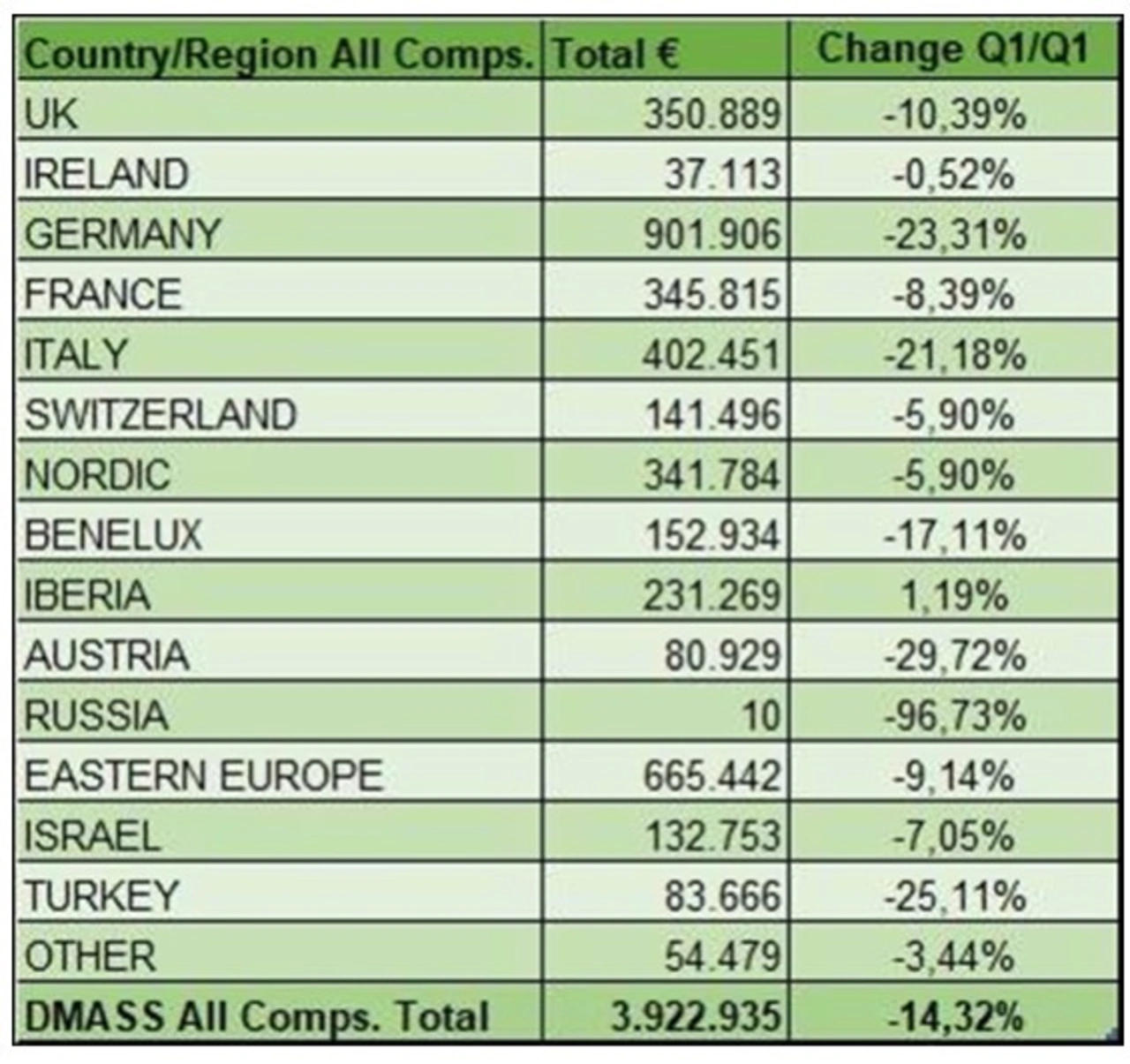

According to DMASS Europe, the European components distribution market contracted by 14.3%, with consolidated sales reaching €3.92 billion.

The corrections in the European components markets persisted through the Q1 of 2025. The distribution industry, having thrived in the past, is now facing disproportionate declines.

Once again, IP&E (Interconnect, Passive and Electromechanical) components demonstrated relative resilience, declining by only 4.63% to €1.55 billion. In contrast, Semiconductors continued their steep downward trend, plunging by 19.59% to €2.37 billion."

Hermann Reiter, chairman of DMASS: The Great Business Realignment? Q1 Results Show Mature Economies Losing Pace; Smaller Markets Gain Ground as Germany, Italy, Austria & Turkey Face Sharper Q1 Losses. The first quarter of 2025 saw a decline compared to the still strong first quarter of 2024, continuing the trend. However, Europe is witnessing mixed signals. The GDP in the Eurozone increased by 0.4%, suggesting a slight recovery. Despite this, uncertainty remains elevated due to geopolitical tensions and new tariffs impacting the markets. Overall, the economic situation remains challenging, but there are indications of stability and long-term adaptation. In this turbulent economic climate, robust distribution networks are more critical than ever.

Semiconductors

Semiconductor distribution sales in Europe experienced a significant decline of nearly 19.59%, amounting to €2.37 billion. Among the major countries, Austria faced the steepest drop with a decrease of almost 39%, closely followed by Turkey with a reduction of nearly 37%. In contrast, Ireland, Switzerland, Iberia, and the pool of smaller EMEA countries performed notably better

At the product side, weakest sales were in Power and MOS Micro Logic with a minus of over 25%. Only Programmable Logic showed a slight increase about 2,63% and did much better than average with nearly 20% minus. See table below.

Interconnect, Passive and Electromechanical Components

In IP&E, the worst seems to be behind the distribution market. The slowdown continued at a much lower rate, with only -4.63% to 1.55 billion Euro.

Only Austria & Germany showed an over-proportionally steep decline.

Product-wise, Passives (-7,62%) showed a bigger minus than Electromechanical components (-2,82%) and Power Supplies(-3,75%). Biggest decline could be seen with Capacitors (-12,6%), Frequency Control Devices (-11,1%) and Relays (-14,8%), while Circular Connectors (+12,8%) showed a good increase.

Chairman Hermann Reiter concluded: “When considering the bigger picture, a nuanced view emerges across different parts of our world. The massive disruptions in global trade are reflected in financial markets and the economy. New structures will emerge that account for these disruptions, with a tendency to value proximity and security more highly than in the past. Our industry, with its enormous innovation potential, will face significant challenges but will also provide many solutions and perspectives in return. The real challenges lie in the transformation of known structures and the need to meet this high pace of change with resilient processes. We will respond to many changes positively with innovations. The old adage remains true: great challenges always bring forth great solutions. The era of administration is over; now comes the time for innovation.”