Interview with Gregg Lowe, CEO of Cree

One Billion Dollars For SiC Capacity

Wafer capacity is the bottleneck in commercializing silicon carbide. At PCIM Europe 2019, Gregg Lowe, CEO of silicon carbide pioneer Cree, announced to invest one billion dollars into SiC and GaN capacity. DESIGN&ELEKTRONIK was able to talk to him on his plans right after this announcement.

DESIGN&ELEKTRONIK: Gregg Lowe, just a few minutes ago you announced that Cree is going to invest one billion US Dollars into capacity. Where is this money coming from?

Gregg Lowe: We have recently closed the sale of our lighting business to Ideal Industries. This transaction is worth 310 million. The rest comes from our strong balance sheet. We are going to invest this sum over the next five years.

When are you starting invest?

Gregg Lowe: Right now.

Last year you said to me, Cree doubled its capacity since you came on board in September 2017, and Cree is going to double it again till 2019. What is the new plan?

Gregg Lowe: If you take September 2017 as a baseline, we will expand our capacity by 30 times.

Can you please be more specific? In which projects will this amount be invested?

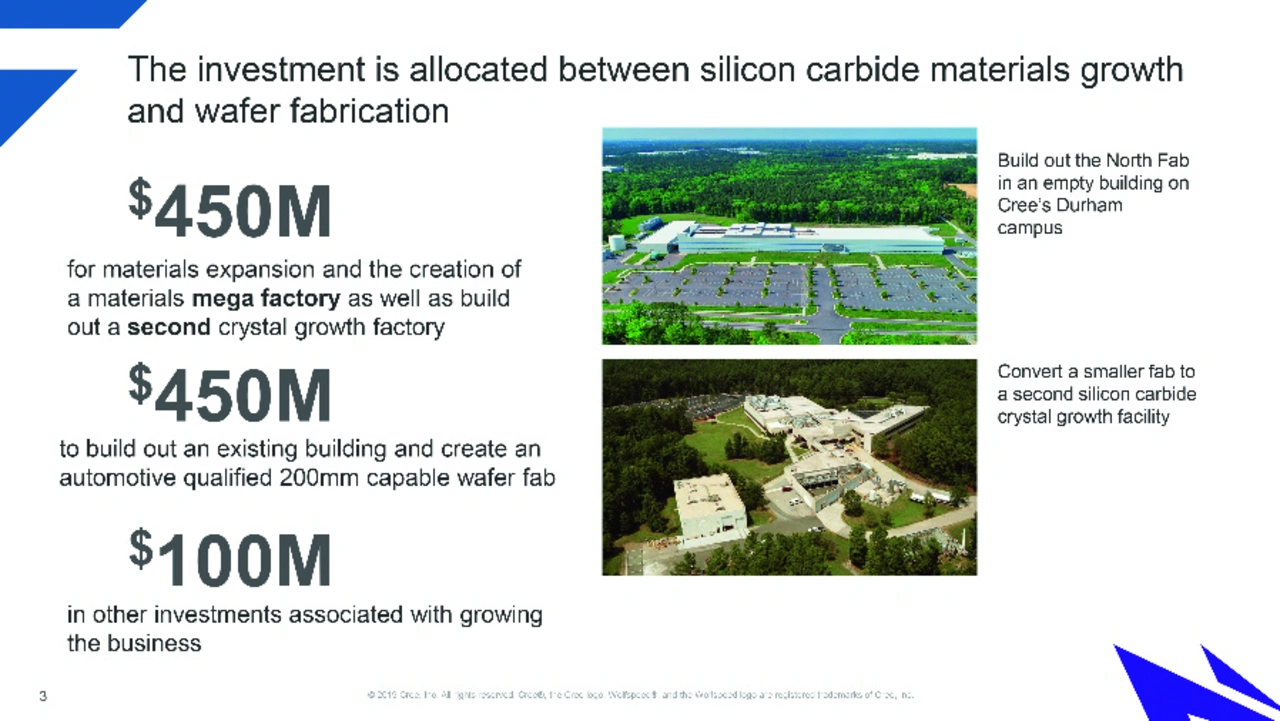

Gregg Lowe: The capacity expansion is based on three pillars. Firstly, additionally to our existing materials factory we will build a Materials Mega Factory on the Cree Campus in North Carolina for 450 million dollars. There the raw material will be grown and then sawn into wafers. Secondly, we will equip an empty wafer fab on the Cree campus for another 450 million dollars to process 150 millimeter wafers. However, this so-called North Fab can easily be upgraded for 200 millimeter wafers as soon as market demands this. This could be in the middle of the next decade. Thirdly, another 100 million dollars will go into other aspects of the expansion.

When will this North Fab ramp up?

Gregg Lowe: In our fiscal year 2022. It’s also worth mentioning that our investments in the materials business will include us bringing up a second site that is a few kilometers away and will be supplied from another power grid. This will give us and the industry more security and stability in the supply of raw wafers.

Let’s come back to the selling of Cree’s lighting business. I remember talking to you at electronica 2018 about the issues with the lighting business. I proposed to sell it, but you said that you are going to fix it.

Gregg Lowe: And we have fixed it.

By selling it?

Gregg Lowe: No. We fixed it first, and then we sold it. We had to fix it anyway, whether we wanted to keep it or sell it. As you can see from our results for the second quarter of our fiscal year 2019, we have been able to leverage the gross margin of our lighting business from 15.9 percent in December 2017 to 25.7 percent in December 2018! And in the same time its gross profit rose by nearly 50 percent! Our team did an amazing job to fix this.

But selling the formerly biggest business of Cree is a complete turn-around in strategy, isn’t it?

Gregg Lowe: You are absolutely right. When I joined the company, we quickly identified that our fastest growing business will be Wolfspeed, the power and RF business of Cree. And as we talked about this last year, our target has been to quadruple that business from 220 million dollars annual revenue in 2017 to 850 million dollars by 2022. For this fiscal year 2019 we have a target of 540 million, so we are on a very good path. Therefore, I expect us to surpass the 850-million-dollar mark by 2022.

- One Billion Dollars For SiC Capacity

- The Effect on Research and Development